December 20, 2024

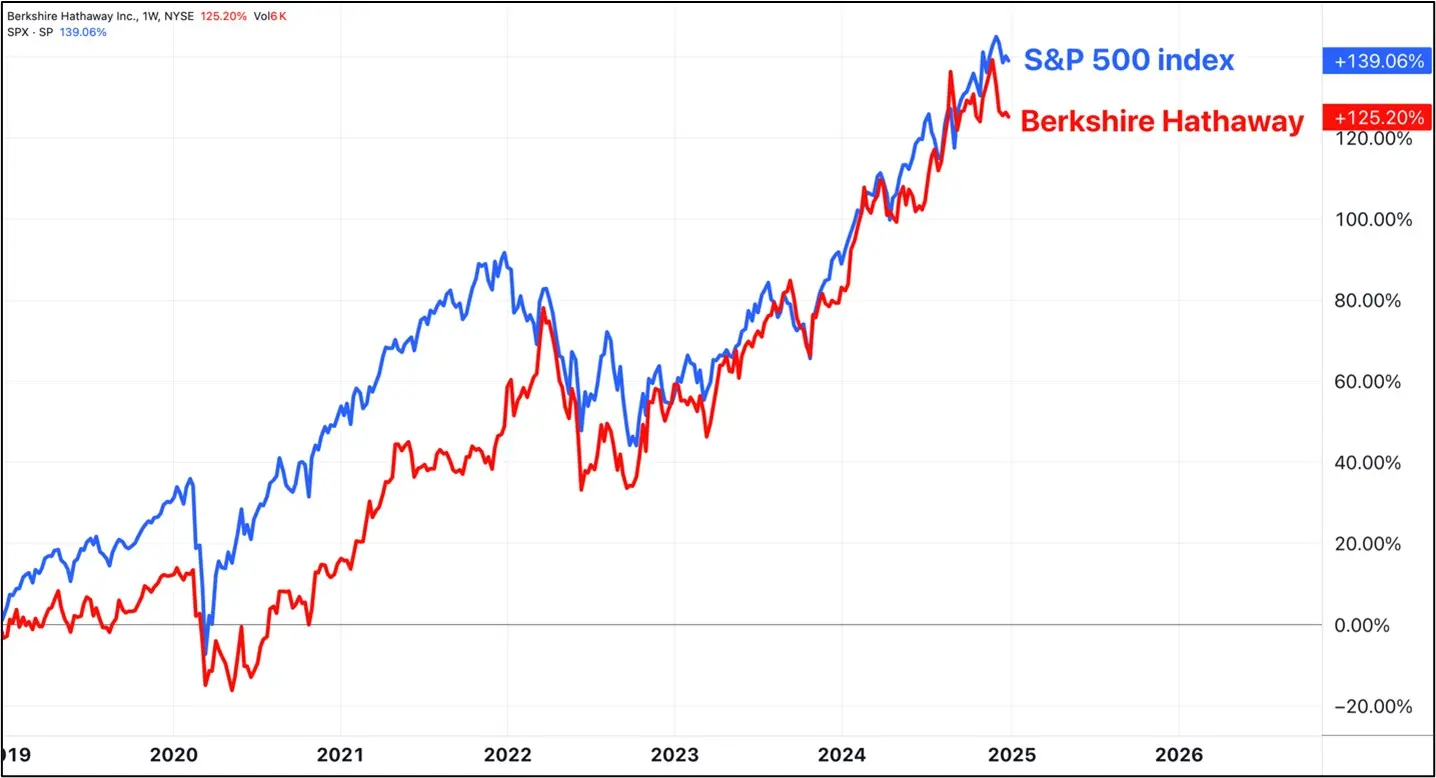

Buy and hold is dead.

Warren Buffett can scoff all he wants. He’s lucky if he outperforms the indexes these days.

(Link to full resolution image: https://www.tradingview.com/x/xArxNy9U/)

This is not your father’s stock market.

You will not get rich holding Texas Instruments for 20 years.

Things change too fast today.

Broadband and computer code allow companies to scale at a once unthinkable pace.

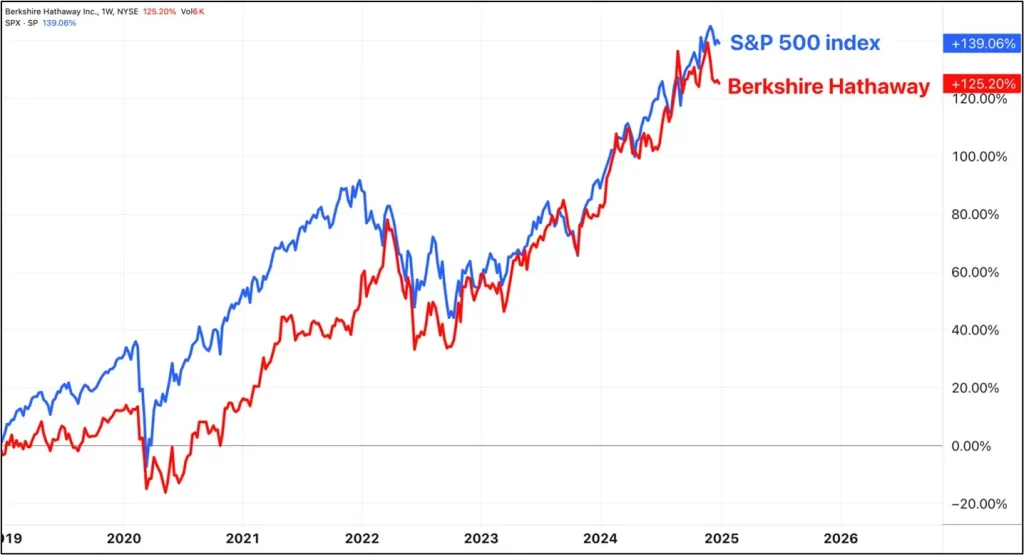

It took the credit card industry 28 years to reach 50 million users.

YouTube accomplished the same feat in 4 years.

Twitter did it in 2.

Pokémon Go reached the 50 million mark in just 19 days.

And no… I wasn’t one of them.

(Link to full resolution image: https://pbs.twimg.com/media/DUPG8xCW0AE0j7F?format=jpg&name=large)

Trends change fast. New competitors come out of nowhere. Yesterday’s hot stock can become tomorrow’s dog in an instant.

Blackberry was worth $112 billion in 2007.

By 2012 the value was below $4 billion. It hasn’t gone up since.

The loss was permanent.

Some folks get lucky and hold an Amazon ($AMZN) or a Monster Beverage ($MNST) for twenty years.

Maybe 1 in 100 of those people forecasted the 10,000%+ gain.

The other 99 got lucky.

Most investors do far worse. Even “pros” rarely beat their benchmarks.

That’s because it is almost impossible to predict the next super performer.

The best-performing stocks of the coming decade will be ones you have not yet heard of.

I don’t care how good you are at doing research. No one can predict the future.

But even if you could, you wouldn’t buy and hold it forever. That’s not where the money is made.

Big returns come during the surge.

That’s the only time you want to be holding.

I’ll show you what I mean…

Apple ($AAPL) had a huge run in the two years surrounding COVID climbing 169%

(Link to full resolution image: https://www.tradingview.com/x/4ZjLmVx7/)

But it didn’t go straight up.

There were pullbacks. There were flat periods where it did nothing for months.

Who wants their money sitting idle?

You worked hard to earn it. It should be working hard for you.

Here’s where I want to own Apple ($AAPL):

(Link to full res image: https://www.tradingview.com/x/rYZCQH6b/)

The 8-week period in the red box.

AFTER the trend turned positive.

AFTER it made new all-time highs.

And ONLY while the stock was going up and demonstrating strong momentum.

I know what you’re thinking…

Ross, why would you choose a 37.9% gain over 169%?

Simple.

I only want to capture the surge. For those 8 weeks, AAPL was screaming higher. It never went against you.

Savvy investors were able to book a quick gain, pocket the cash, and move on to the next opportunity.

What if you could find a 37.9% move like that every 8 weeks?

Obviously, that is a ridiculous goal and not something someone could achieve on a regular basis. But just for argument’s sake, let’s see how much better the retuns would be…

Buy & hold AAPL for 2 years: $10,000 —> $26,900.

37.9% every 8 weeks for 2 Years: $10,000 —> $13,790 —> $19,016 —> $26,223 —> $36,162 —> $49,867 —> $68,767 —> $94,830 —> $130,771 —> $180,334 —> $248,681 —> $342,931—> $472,902.

Not bad, right?

$10k to $472k.

A 4,792% gain in two years by taking smaller wins.

Again, I am NOT saying this is realistic. But theoretical example highlights the power of compounding a stream of singles and doubles as opposed to holding out for a grand slam.

As a professional money manager, my job is not just to produce good returns, but to do so as quickly as possible.

The goal is to compound our money.

To do that, we don’t need huge 1,000%+ stock moves. They are not necessary to achieve super performance.

Do the math… four 10% winners are better than one 40% winner. The compounding effect means you are making gains on your gains on your gains.

That’s the secret.

Stick to a proven strategy.

Focus on keeping losses small.

And compound your money as quickly as possible.